M&A Credit Union Evaluation

Blueprint

Switching from a manual, spreadsheet-based process to real-time collaborative intelligence.

Audience

The Scenario

John is the CFO of a thriving credit union. As his institution looks to stay competitive amidst rapid consolidation, John has been tasked with driving growth through strategic M&A opportunities.

While this is a massive opportunity, John is faced with daunting hurdles. He needs to assess a multitude of potential partners, each with varying data points, operational structures, member demographics, and financial health to ultimately evaluate if there is a fit.

While this is a massive opportunity, John is faced with daunting hurdles. He needs to assess a multitude of potential partners, each with varying data points, operational structures, member demographics, and financial health to ultimately evaluate if there is a fit.

The Challenge

The Solution

The Example

Frequently Asked Questions

What is FINsights for Credit Unions?

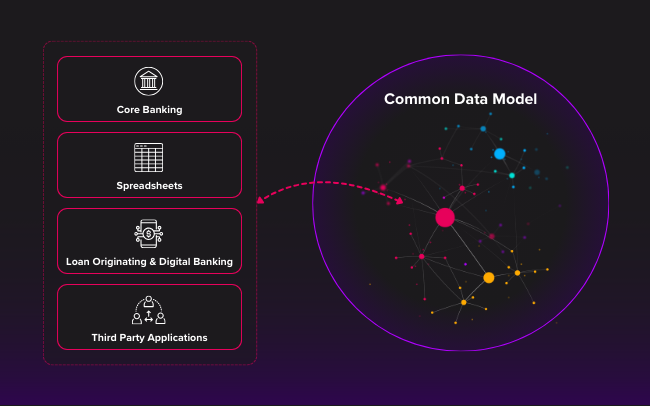

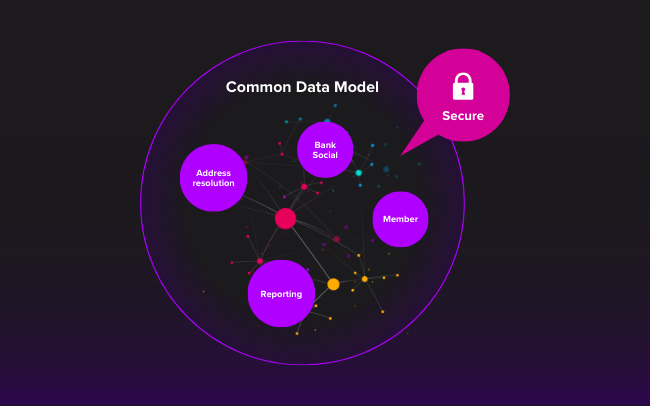

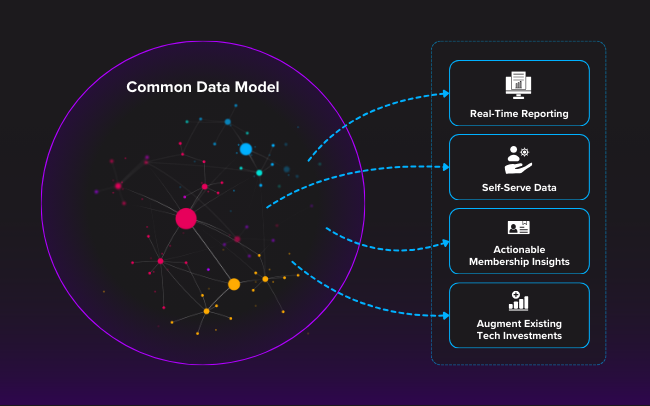

FINsights is a platform provided by Cinchy that offers instant access to comprehensive data, charts, and insights derived from over 20 years of credit union and banking activity. It aims to transform vast amounts of industry data into actionable insights for credit unions, enabling them to make well-informed business decisions.

How can FINsights improve decision-making for credit unions?

FINsights empowers credit unions with data-driven insights, enhancing their understanding of the market, identifying improvement areas, spotting performance issues, and discovering growth opportunities. It provides tools for superior performance analysis, merger and acquisition analysis, and historical data reporting, facilitating strategic decisions that directly impact the financial well-being of members.